Taxjar - Odoo Connector

Taxjar is cloud-based sales tax automation for those who have nexus in states. One more thing, if you have nexus in states and you are familiar with the odoo ERP solution. But unfortunately, in odoo, there is no any feature to manage your sales tax with nexus states. So don't worry our this application will help you to manage your sales tax calculation with taxjar. Just connect your taxjar account with your odoo ERP and that's it.

Hot Features

Features

- Easy to config taxjar with odoo.

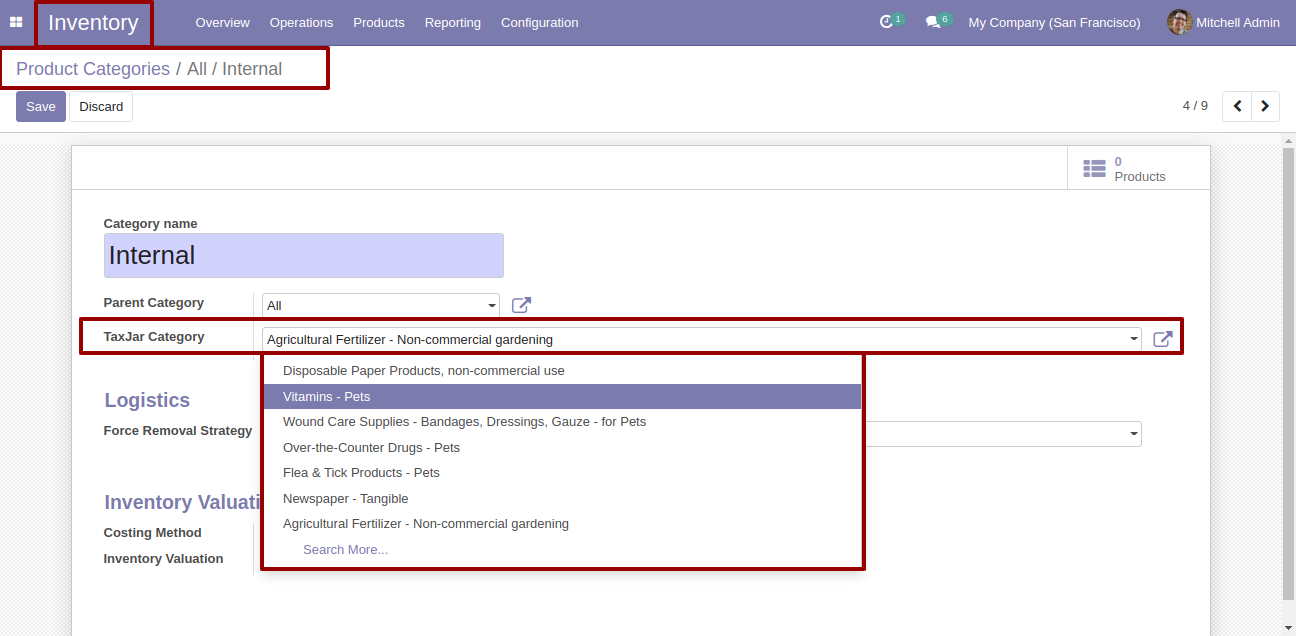

- Easy to import nexus states and categories in one click.

- Easy to set taxjar categories in odoo products categories and categories inside the individual products as well

- Easy to manage customer invoice and credit notes as well.

- Easy to delete the customer invoice and customer credit notes entries from odoo to taxjar.

- No more configurations required.

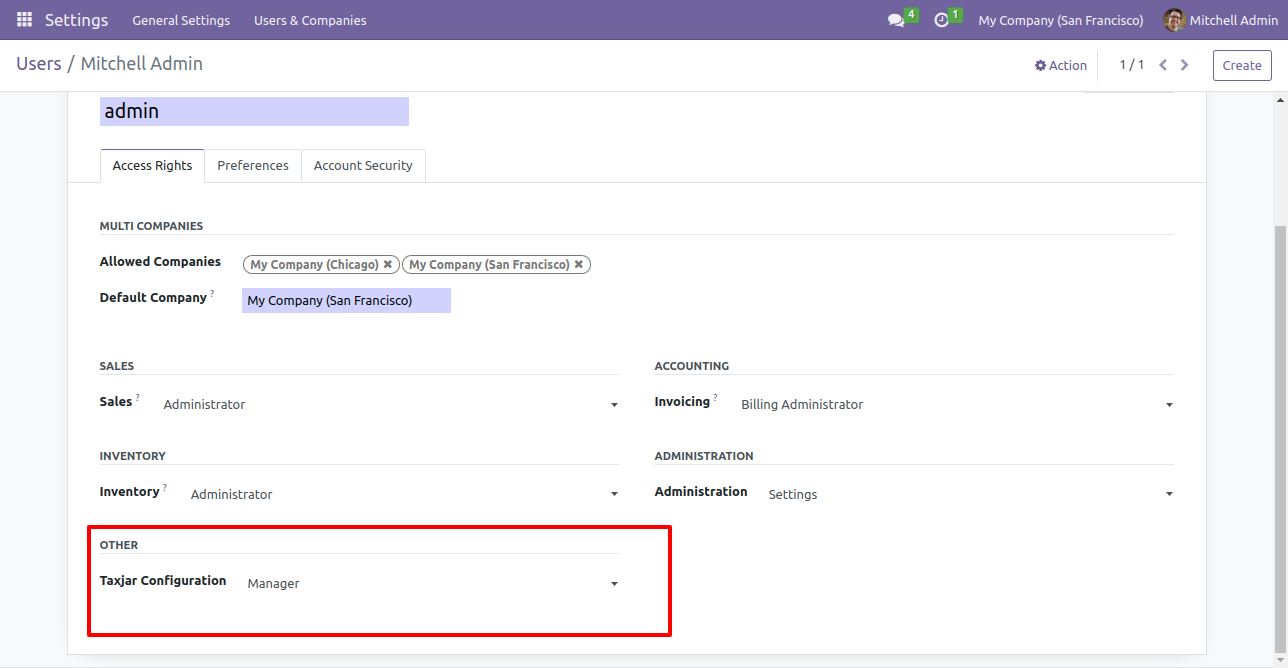

Enable 'Taxjar Manager' for the taxjar user.

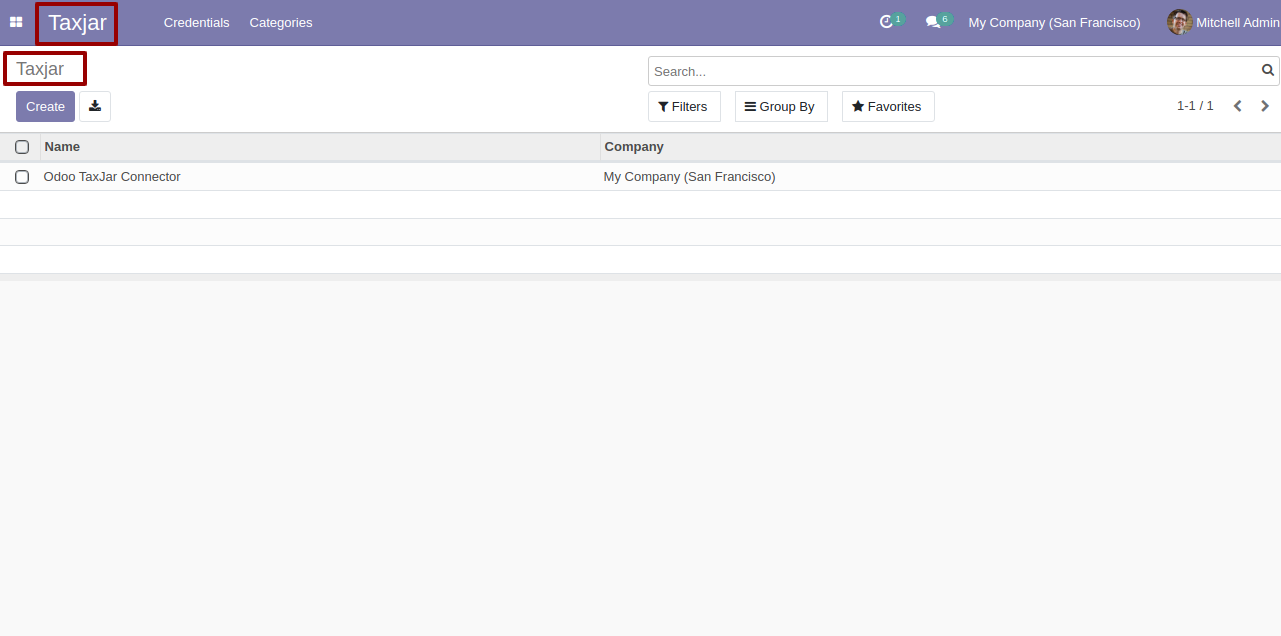

Taxjar tree view.

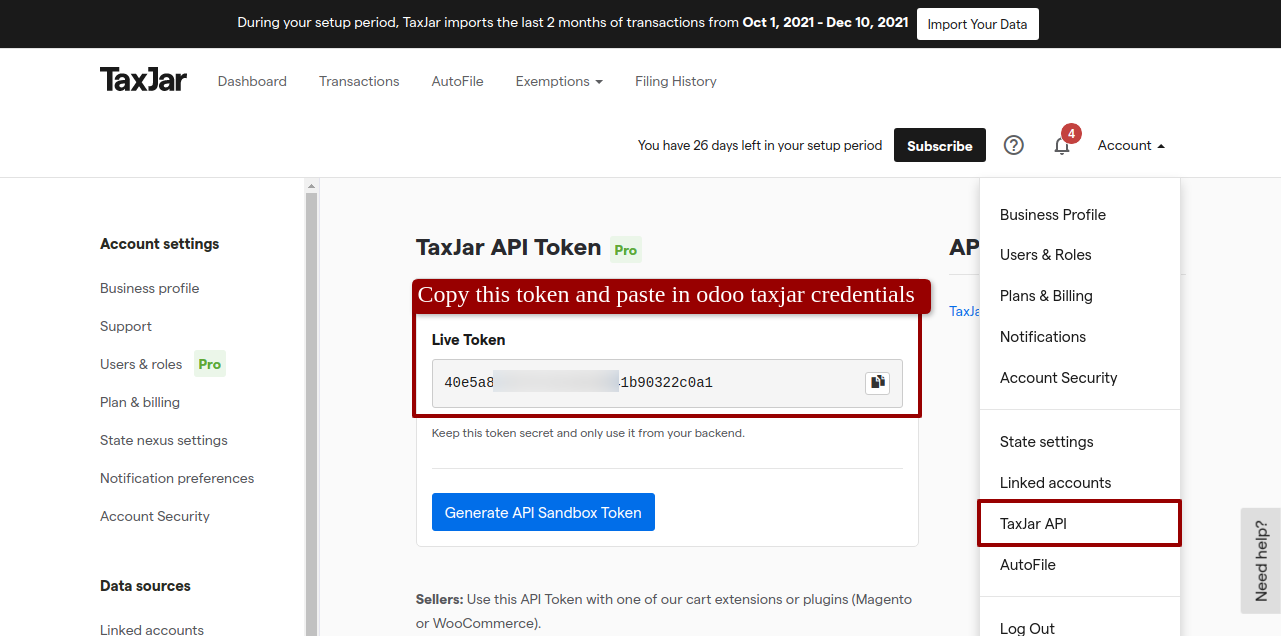

Now goto taxjar dashboard and goto the Account --> Taxjar Api --> Copy Taxjar API Token.

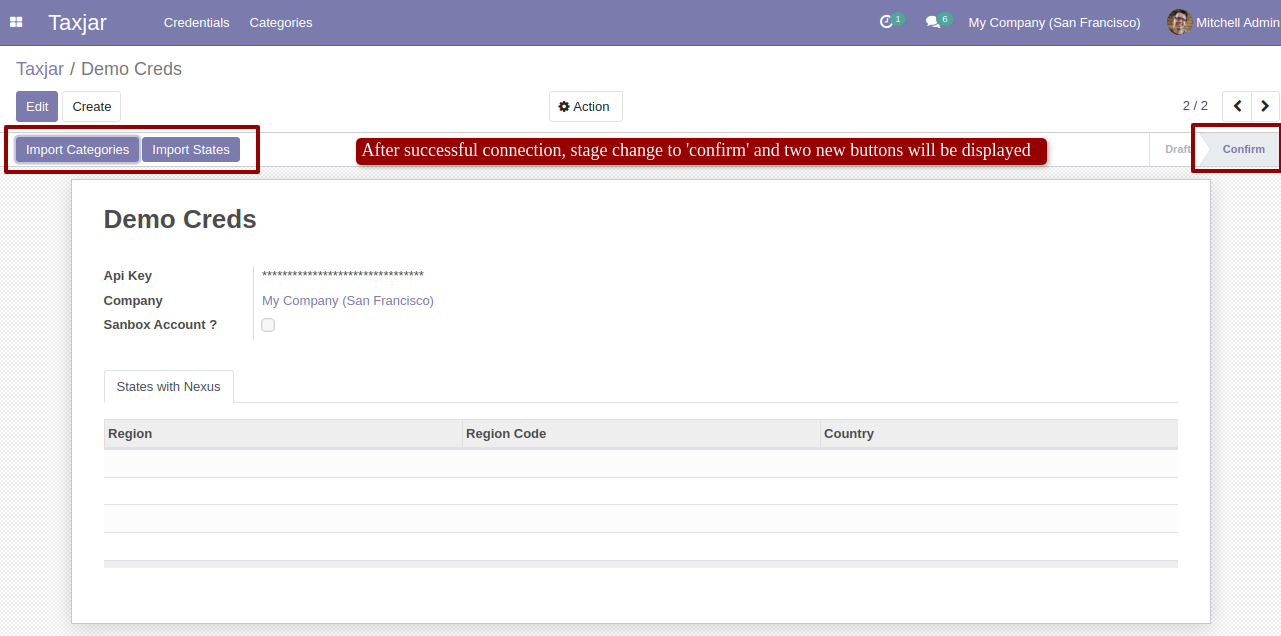

After adding Taxjar API Token and selecting company just click on 'Test Connection'.

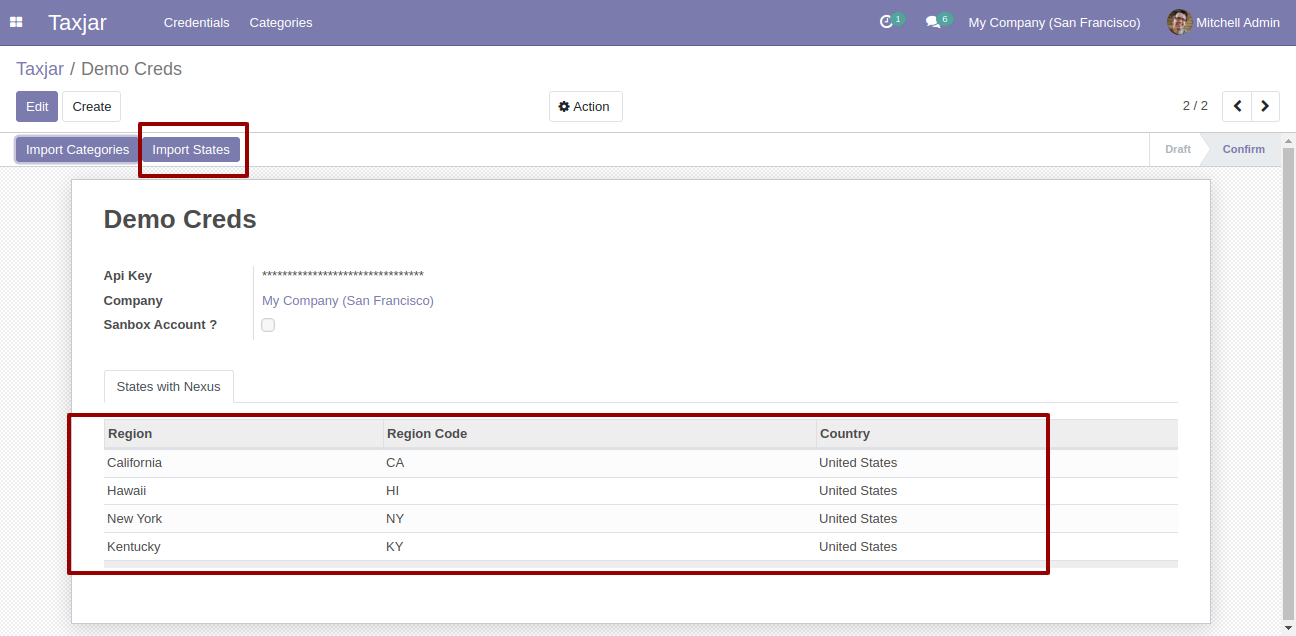

After connection succefuly setup, two buttons are visible 'Import States' and 'Import Categories'. Also state change to 'Done'.

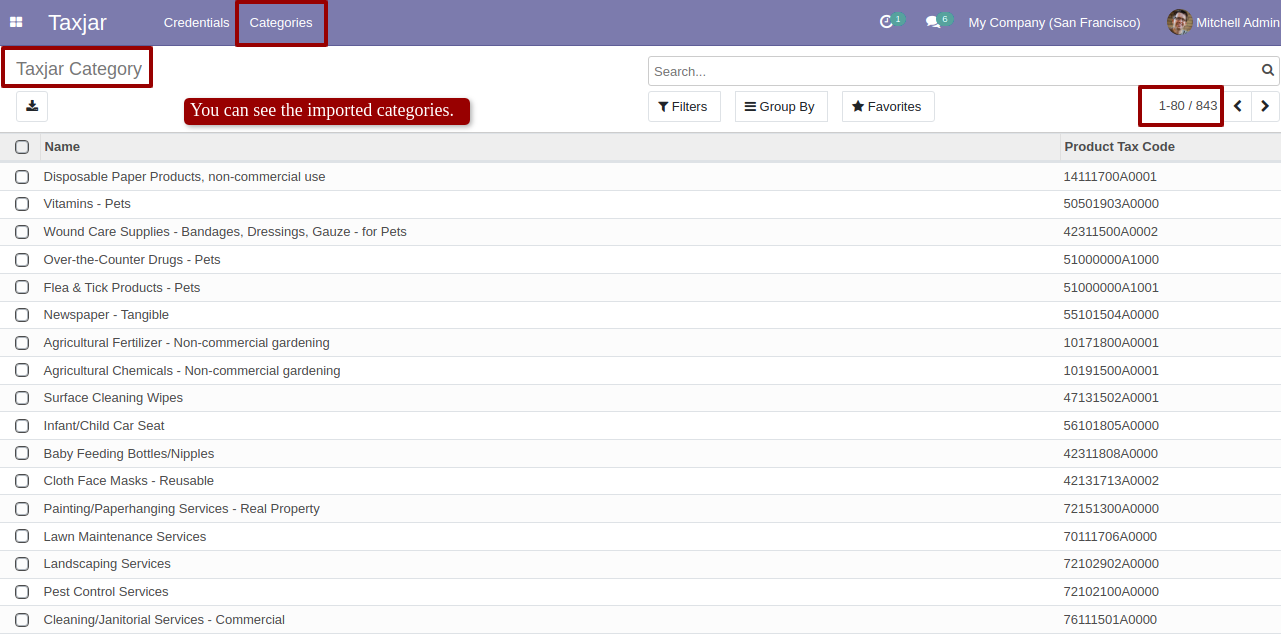

After click on 'Import Categories' you can see the imported categories list in 'Categories' menu.

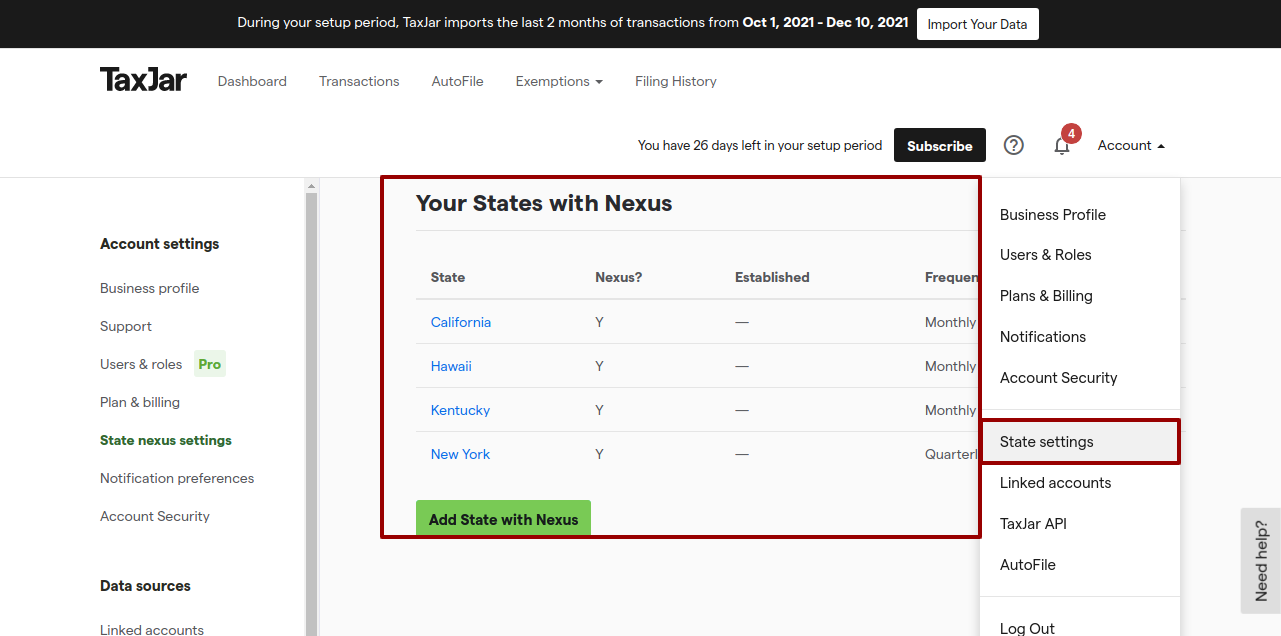

In Taxjar define your nexus states.

After click on 'Import State' you can see your nexus state are imported.

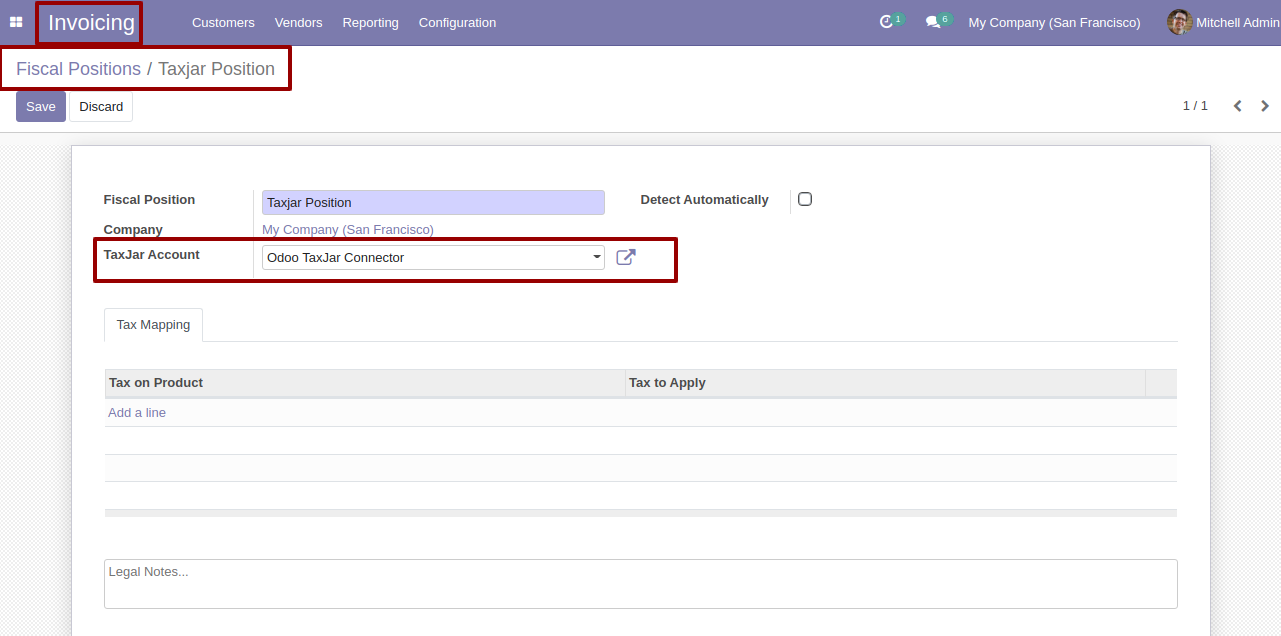

Now, goto in invoice configuration --> Fiscal Positions. Here create a fiscal position for taxjar.

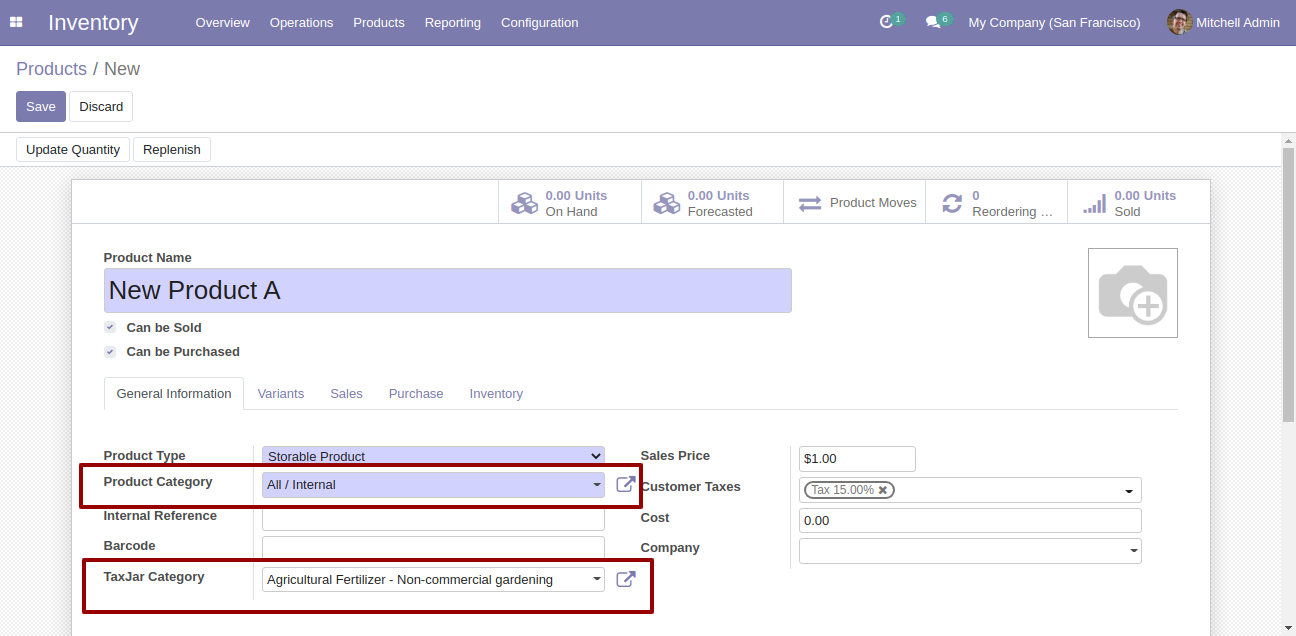

In inventory, just set the taxjar categories into your product categories.

Goto the product and define the taxjar category.

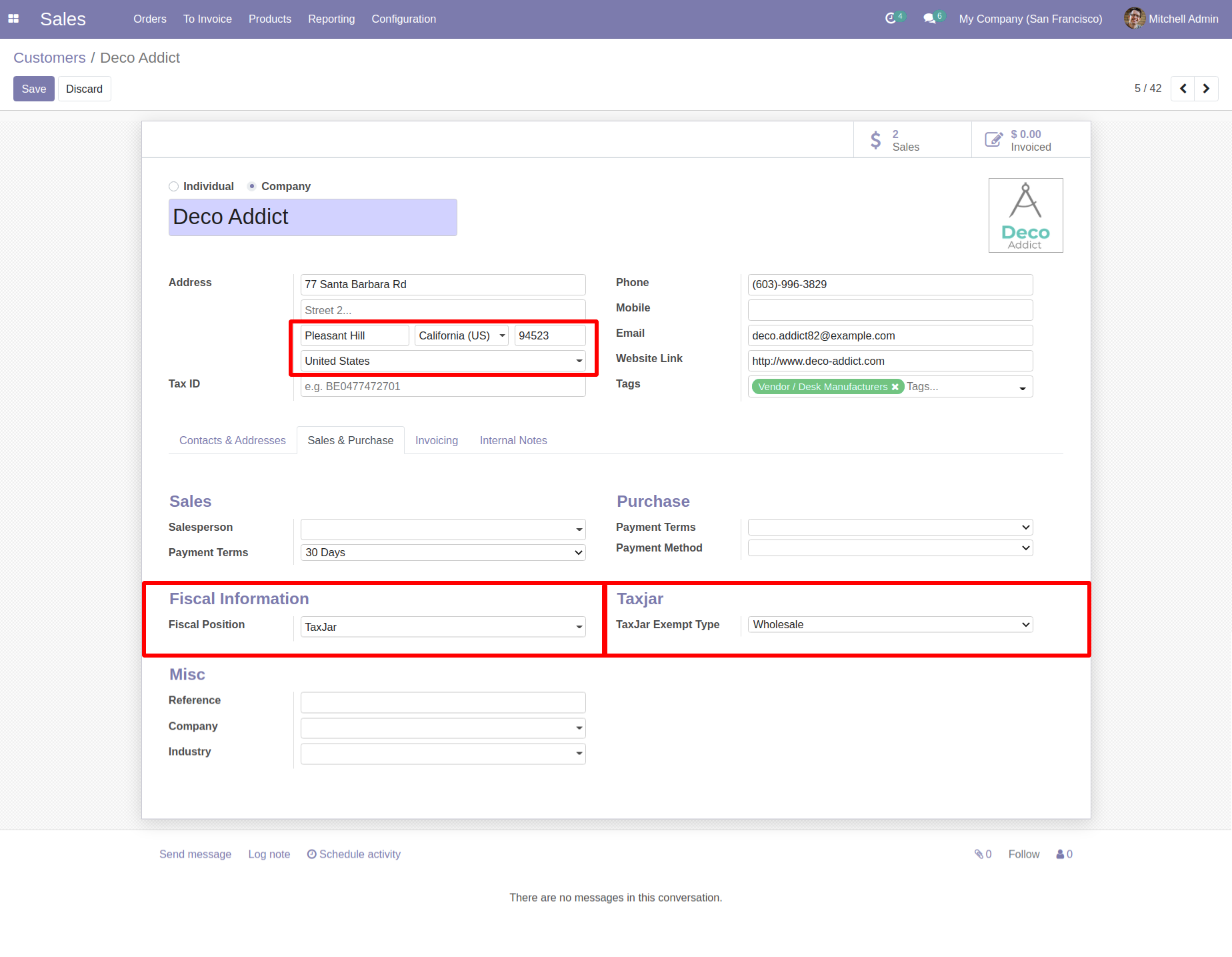

Make sure your customer address, city, state and pin code is correct. And define 'Taxjar Exempt Type' and 'Fiscal Position' as well.

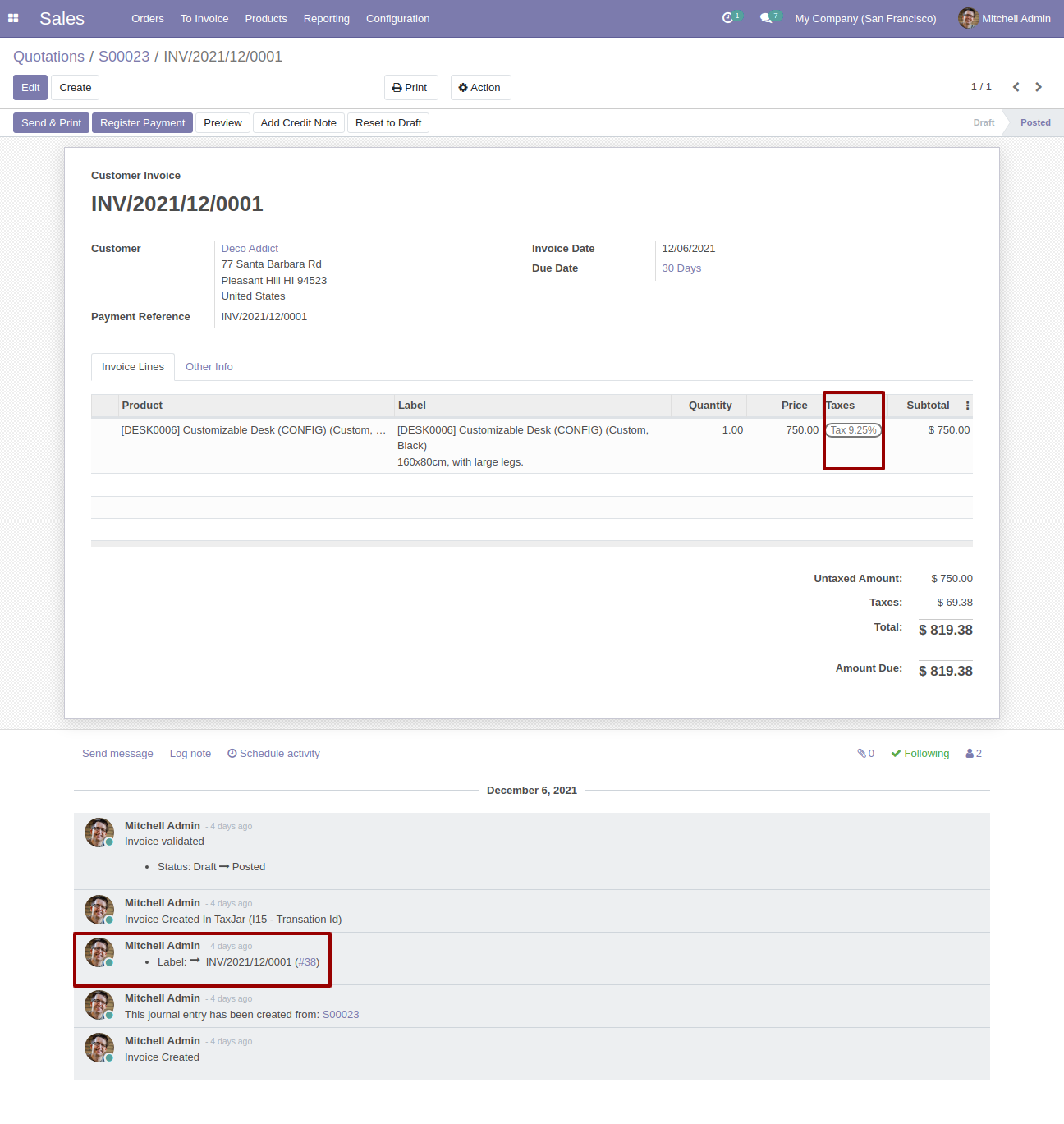

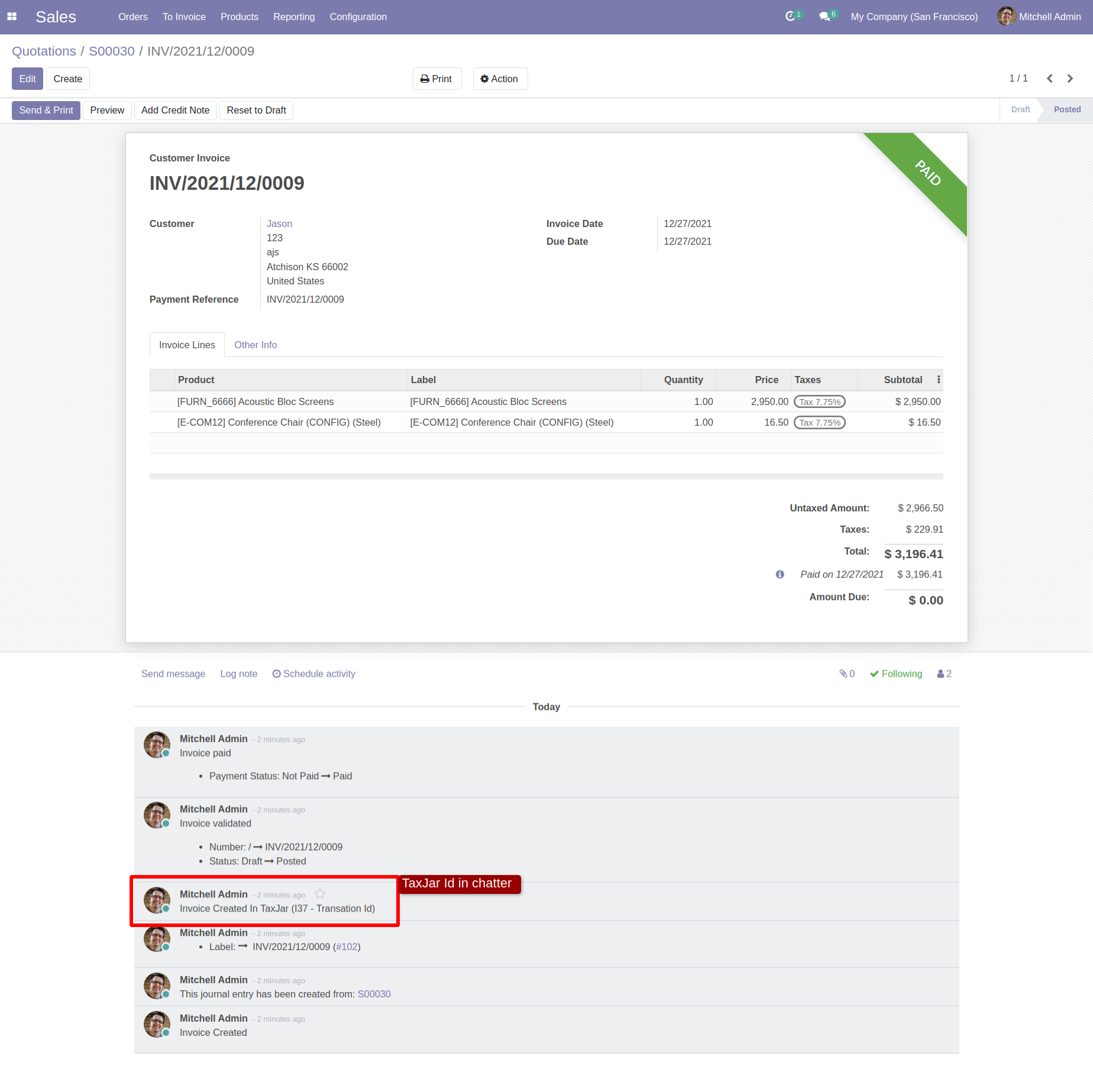

Now make a sale order for the customer and while you selecting the product it will add tax automatically based on the customer state. After invoice is created suucessfully you can see the taxjar id in the chatter for that invoice.

i.e Invoice .

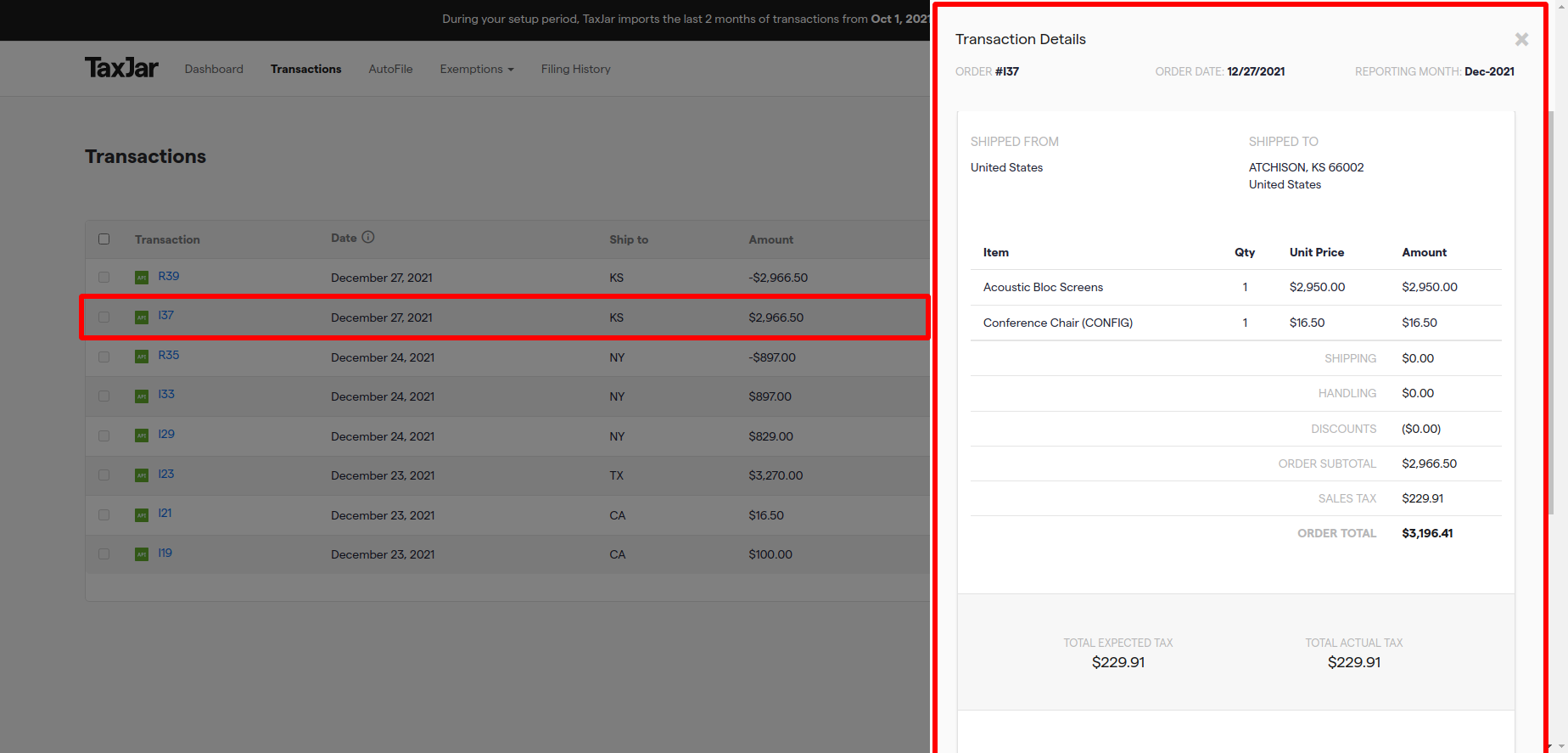

Invoice entry in taxjar.

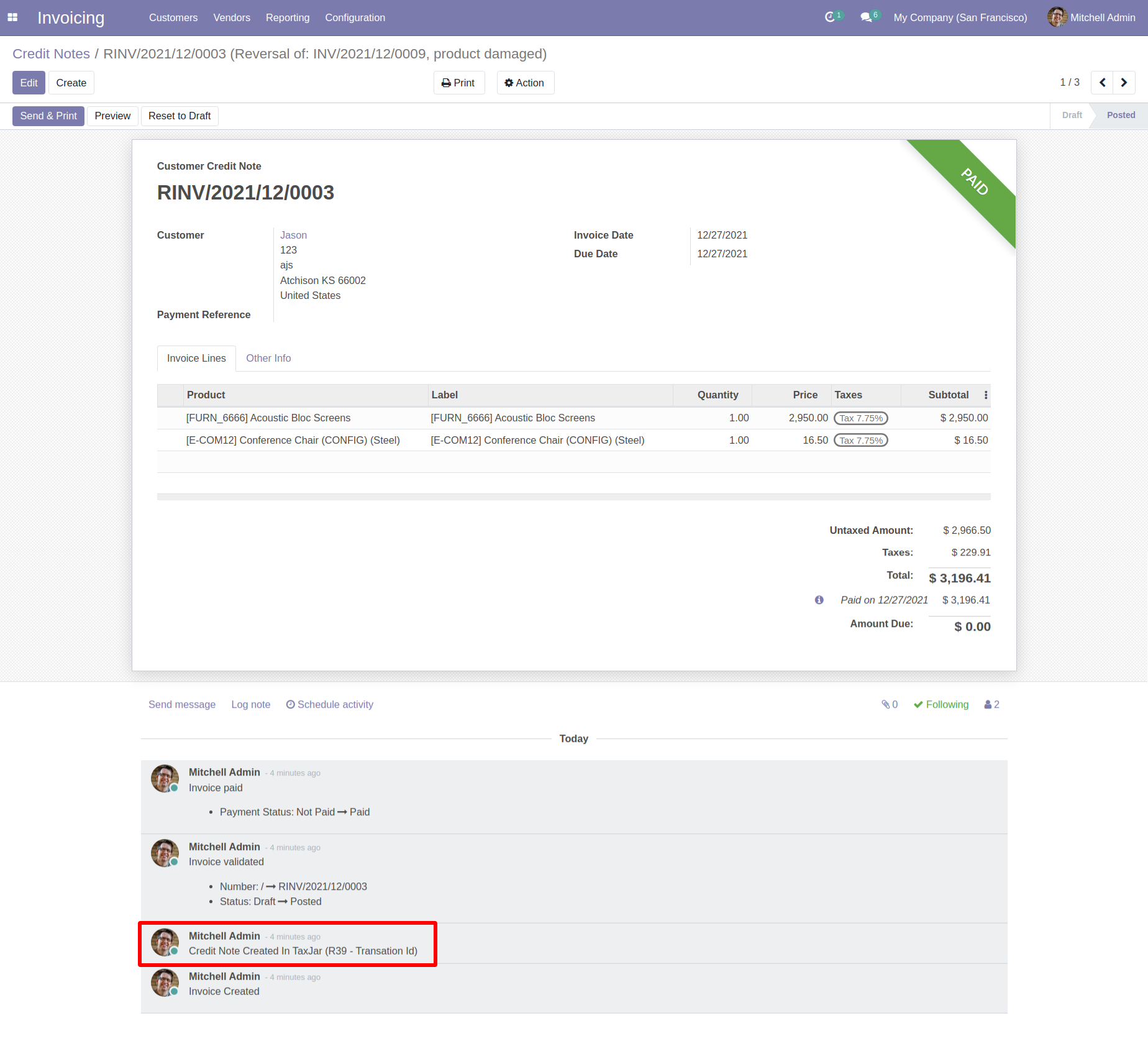

Create a credit note for the invoice and you can see the taxjar id in the chatter.

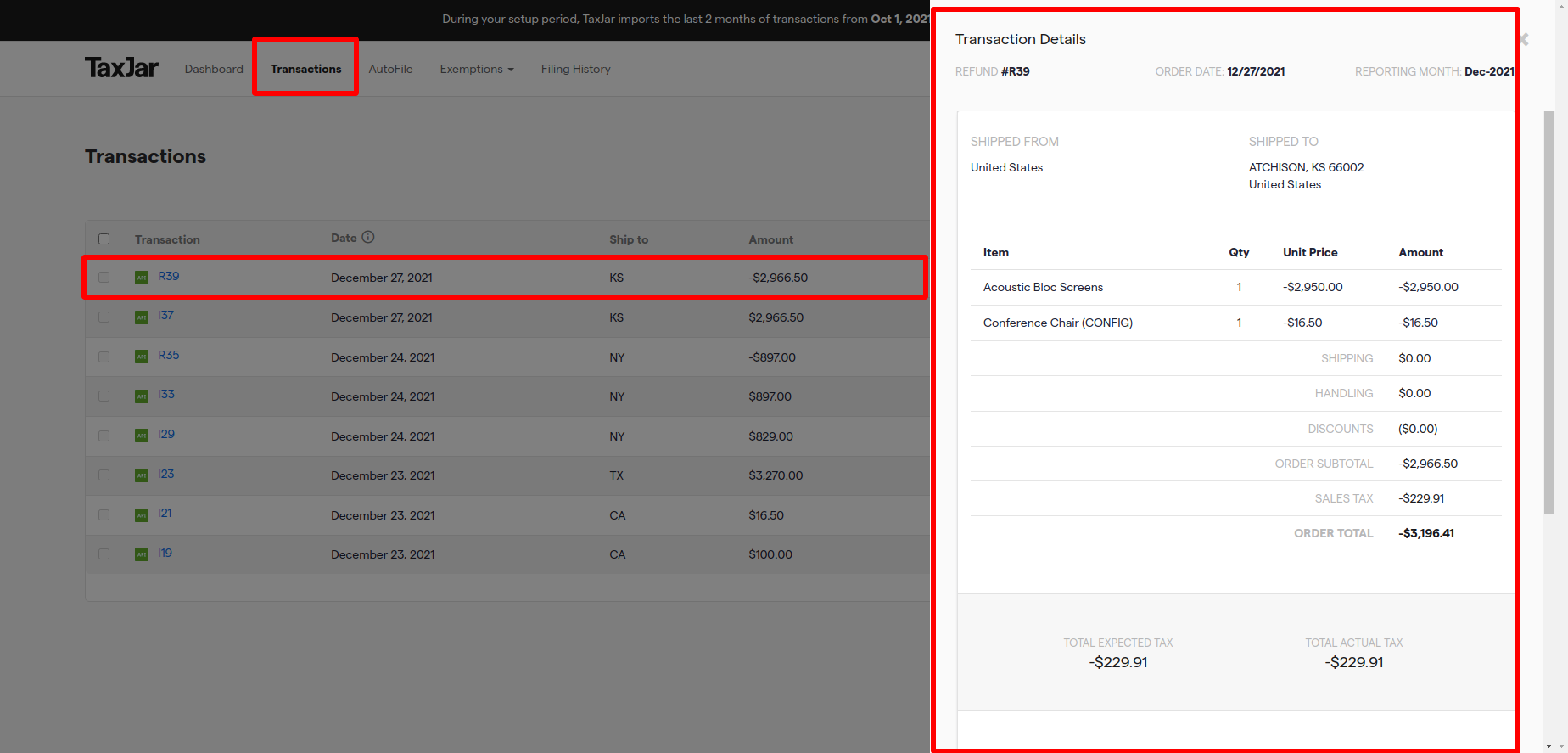

Credit note entry in the taxjar dashboard.

Delete customer invoice entries odoo to taxjar.

Version 16.0.1 | Released on : 28th October 2022

- Yes, this app works perfectly with Odoo Enterprise (Odoo.sh & Premise) as well as Community.

- No, this application is not compatible with odoo.com(odoo saas).

- This app is compatible with Linux, we have not tested it in windows.

- Please Contact Us at sales@softhealer.comto request customization.

- Yes, we provide free support for 100 days.

- Yes, you will get free update for lifetime.

- Yes as we have replaced the full receipt so it's possible another app which extending this can not work properly. We can give paid support to resolve this conflict.

- No, you don't need to install addition libraries.

- Yes, You have to download module for each version (13,14,15) except in version 12 or lower.

- No, We do not provide any kind of exchange.